Previously in MADV… In the last episode, I dropped a 💣 that had implications few fully grasped for their Q4 performance. TLDR: the mobile app installs (MAI) ads reach on self-attributing networks (SANs) is currently shrinking. Start adjusting your Q4 short term and 2021 mid-term strategy & mindset accordingly.

In this post, I’m not trying to cover the many implications of the incoming IDFA partial deprecation, nor how to prepare for it (for such purpose, this guide would be a good place to start), but to observe how iOS14 is already impacting Q4 performance on paid media and make you think about your marketing mix.

First some details on Mobile App Installs ads & iOS14

A few more details before I move to the actionable part, to answer some surprises my initial claim raised among MADV readers. The shrinking reach of SANs inventory is happening from the combination of 3 factors:

😱 iOS14 has higher proportion of users with inaccessible IDFA

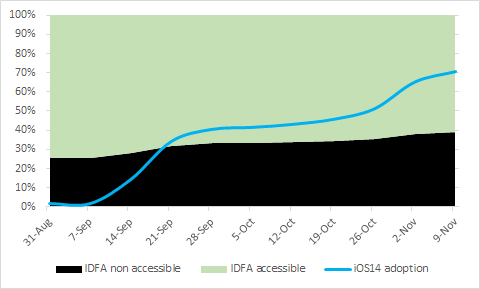

📈 iOS14 is rising in adoption (roughly 70% after a steep acceleration early November)

❌ SANs only show MAI ads to users with an advertising ID.

- LAT rate is not on an increasing trend on iOS14 , it’s stable at 45% on iOS14. It’s the combination of higher than iOS13 + rising iOS14 adoption that makes it look like it grows over the whole iOS userbase.

- SANs (mostly) not showing MAI ads isn't a new phenomenon, it has nothing to do with iOS14 and it's been the case for as long as I’ve worked in this industry 👴. SANs aren't showing MAI ads to IDFA0 users because they rely on advertising IDs (IDFA on iOS) to match & report attribution, at least outside their own biased reporting. I've said it previously but nobody really seemed to care that 20 to 40% of their audience wasn't reachable through their core channels. Insert “it’s fine” meme.

- Besides limiting reach, the rising IDFA is also affecting how adgroups using narrow lookalikes perform, as Facebook is only left with an even smaller potential audience.

- It's not only Facebook as I simplified earlier due to their dominant share of the iOS paid installs: Admob, Youtube & what I call "secondary social" (Tiktok, Snap, Twitter*, Pinterest...) all do the same. (For the record, Google UAC always showed MAI ads on search, but that’s a relatively small share and since 2020 search’s extrapolated conversions only live within Google Ads UI and don't get passed to MMPs as they can't be attributed at user-level).

EDIT 17/11: I’m told by a MADV reader that Snap is now offering LAT-on traffic for MAI in testing, but only reported in their UI, no data passed to MMP where those will show up as organic. I suspect Twitter doing the same.

-When saying “SANs” (aka “SRNs”) , I’m talking primarily about their first-party inventory (which others call “O&O”, owned & operated, namely: Instagram, Facebook, Tiktok, Youtube, Snap..), but it also applies, possibly even stronger, on third-party inventory (Audience Networks, Admob…).

- Toggling on LAT isn’t an ad-blocker: users without accessible IDFA still get ads, but not SAN mobile app install ads. At least that I know of to the same amount. You can easily experience what it’s like by switching your iPhone to LAT-on and open whatever endless feed you waste your time on these days. As a corollary, this shift means the mobile web inventory pressure is very slightly decreasing in parallel. I bet a few ecomms will be happy just before black friday & Xmas coming to see app advertisers leaving inventory on the table, even more so this year when we're -almost- all stucked at home. It also mean that such users start getting randomly targeted ads, a topic for another day.

- This limitation doesn’t apply for 2021 if/when SANs switch to SKAdNetwork attribution, all users will get app installs ads regardless of their IDFA status (although some optimization might depend partly on the IDFA-on traffic, which is still unclear at this point).

Q4: the red pool

2021 will likely be a completely different game for mobile UA. Hence the panic of some, the ostrich effect on others, and the overdose of IDFA news, most of which barely scratches the surface of the incoming tsunami. In the meantime, behind the FUD speculative headlines, the combination of limited reach & increased demand is already putting double the pressure on the profitability of paid UA on the leading app ads networks in the short term. How are your Q4 volume & profit goals doing so far? For most, the answer is not that great 📉 .

Per my estimates based on Mixpanel, Appsflyer & Kayzen data (thanks for sharing!), the proportion of inventory not reachable on SANs is currently up by over 50%** compared to early September, and will likely rise a bit further by the end of the quarter. The share of devices without accessible IDFA is even higher in some countries (starting with the US...) and verticals (VPN apps anyone?).

Just like vendors had to move from denial, anger & bargaining to acceptance real fast in Q3, Q4 is the time for advertisers to follow suit and start adapting already. As for SANs, they probably don’t need any of my help to keep racking in billions, even though I was amused at hearing (a big) one stuck at denial...

“If you're only using Facebook, Google and other SAN's MAI Ads for your paid promotion, you're not reaching a growing share of your target audience” <Click to tweet>

Here’s one reason among many your Q4 may look poor, or plateau’ing so far: you’re fighting in a red pool. You’re also swimming against the current: competition for the remaining IDFA inventory on SANs is fierce. For some, especially among earlier/smaller/indie & non-gaming advertisers, the issue is particularly acute: the 2 biggest SANs alone concentrate a very high share of spend & paid installs. To add some bad news, LAT users are in many cases even more valuable than users with IDFA assigned (something that Apple once briefly disclosed before editing the mention).

Reaching LAT users beyond SANs

More than ever, diversifying beyond the duopoly matters. The more deterministic the attribution of your channels, the least you're currently reaching the growing base of IDFA0 users. To promote your app to these, you’ll need to consider both where you can reach them, and how measurement will be performed.

Organic sources such as search, browse (featuring, charts, apps you may like) aren't affected and all users get similar exposure. Scarce visibility from AppStore Connect.

Apple Search Ads always was a very particular “SAN”: showing ads to LAT users***, but reporting them as organic ,a topic I’ve covered extensively in the past, which became even more tricky since Apple stopped reporting LAT status on iOS14 in October.

SDK adnetworks, such as Unity, Ironsource, Vungle, Applovin, Adcolony or Chartboost , have always shown ads to IDFA0 users (tracked through fingerprinting), unless you specifically excluded them on your own. My personal tip on this: if you can, do bet on both cohort, but split them and analyze them appart.

Open programmatic & the endless stream of DSPs have also been quite smarter than their walled-garden counterparts in that regard, assigning a different value (CPM) to the cohorts with/without IDFA, to match the gap in demand, optimization potential (contextual vs behavioural) and “attributability”. Some players even started to market this segment heavily recently:

Liftoff alleged to have matched and/or improved CPA & D7 ROAS for Playrix on non-personalized LAT traffic (more pitch here).

In another Playrix case study I can’t link publicly to, CrossInstall saw “saw double the purchase rate on LAT traffic compared to IDFA traffic”.

Persona.ly claims to match eCPI with 20% higher D3 retention for Tilting Point. A few others pitched customers with questionable case studies in the same manner. I want to believe them, but the shared data looked weak to me to support their stance.

On top of these fairly conventional app marketing channels comes a hidden part of UA which is hard to quantify as it isn’t showing in usual benchmarks of paid channels for apps, such as the Appsflyer Index or Appsumer report I shared in MADV previously, because they aren’t easy to normalize across advertisers:

Less conventionally attributable channels, such as podcasts, TV and all offline naturally don't apply any kind of filtering.

The elephant in the room is influencer marketing, which can only grow further in a post-IDFA world, and the improved attention on incrementality modelization overall should help improve measurement for these actions.

Web to app acquisition isn't affected at this point either, on owned (your website), earned (PR, community) and paid (Outbrain, Taboola, and all MAI acquisition going through an intermediary landing page, or even a (re)direct deeplink scheme). The smartest app advertisers already noticed:

“The most technically. ambitious hypercasuals are now trying to make web campaigns work now. Before HCs never cared much about web traffic”, Matthaus Krzykowski

The same comment applies to “tracked virality” & social links (I’m not talking about real word-of-mouth here)

You can also run “classic” acquisition campaigns on Facebook, Google & other SANs directing to a web landing page, redirecting later towards the app. Whether that landing is going straight to the store, or after signup/payment is a topic I’m quite interested to debate with practicionners in private, but will leave for another spicy MADV episode.

Most of those partly or entirely depend on web to app measurement, and I have concerning questions regarding how to attribute web to app traffic in 2021. It isn’t a use case covered by SKAdnetwork (what was Apple thinking here?!), and no decent advertiser can be satisfied by the campaign URL scheme Apple offers in AppStore Connect. I overheard about a few hacks & DIY methodology I am quite doubtful about…

How much of your current marketing efforts are all of the above representing for your app(s)? For many I know personally, the non-organic sources above are either a small minority, or entirely missing. For the record, I admit I have a large bias of working with many early stage startups, this isn’t necessarily representative of large advertisers media mix.

Don’t wait for 2021 and rethink your media mix already

With the current high level of uncertainty on the exact mechanics of SANs with SKAdNetwork, and their associated performance compared to the IDFA era, I believe the time to start adjusting to the fact IDFA deprecation is already behind us. Kudos on Eric Seufert for having seen it all years ahead, as usual.

Sure, there is already an depressing list of hot topics to prepare for the IDFA doomsday ☠️, including testing ATT prompts, adapting internal BI for aggregated data, developing incrementality/media mix models (MMM), running first-24h data vs LTV regression analysis… My point today is that a missing piece to prep 2021 is rethinking your channel mix for the short-term (SANs inventory) and the mid-term (no IDFA world).

Don’t shoot the messenger. We’re all busy and I’m adding bad news on the pile. There are always 2 faces of the coin, so here are some things to rejoice about:

On the seller side, after years of status quo in the duopoly marketshare (over)dominance, the delay in IDFA deprecation is an occasion for more open alternatives to grow their share of adspend by exploiting this temporary SAN weakness. Will advertisers tap on it, or let their competitors benefit?

On the buyer side, after suffering from the commoditization and leveling (down) playfield of UA management as networks force them to ML-based optimization, it's a fantastic opportunity for smart marketers to make a difference by thinking out of the (black)box of the duopoly. I’ll provide more depth on how to evolve as a UA manager in 2021 at AppPromotionSummit in december, keep posted.

Like a smart reviewer of an early draft of this post told me, one may argue changing the direction of your channels mix is very short-term sighted, and can only give you an edge for the next 6-8 weeks before things get shaken again. I believe there are various reason to pay attention:

It’s still a critical period to deal with for many businesses! If your plan is to follow to status quo until IDFA actually dies, you’re missing out. Why not save the quarter and win next year?

Who’s to say enforcement will start in January anyways? Apple vaguely said “early 2021”. The last-minute September update could be the first of a couple delays. Devs working in the kids apps space know it took a few of them over almost a year for initial the big splashy anoucenement to go live (and a few more month to effectively be enforced).

Most importantly, it’s about building a more resilient marketing mix for the mid-term, while developing new, smarter skills within your acquisition/marketing/growth workforce. In particular, thinking outside the SAN(d)-box can only help raise useful questions about improving measurement perspective, as well as completing the app marketing lense with web & non-direct response marketing capabilities, to embrace “full stack marketing”. In MADV 004, I‘ve said the hottest topic of 2020 was incrementality in UA. Take a moment to think where you’re at on this complex but fundamental question.

The temporary, unexpected and long due disruption of the status quo is an opportunity to anticipate a much bigger picture. Nobody wants it, everyone wants to believe it’s for a far tomorrow. Not only the best prepared will prevail, but the “new normal” (sic) of UA has already started.

The beginning of the end of the AppStore paradigm?

The current situation, in-between the comfy period of deterministic attribution and the yet unknown post-IDFA world coming, is a good, overdue time to rethink your overall distribution strategy, short & long term, and its likely dependencies on current measurement practices & SANs dominance. Make that thought broad: most app marketers (including myself) tend to think of the IDFA deprecation through the very narrow scope of the current AppStore paradigm. I’m writing today about app acquisition channels details, without anticipating that all the IDFA smoke & mirrors talk may only be “a distraction from the more fundamental parallax scroll of evolution in consumer tech” coming at us: a post-platform mobile future. The 2010-2020 AppStore era may only have been the initial piece of a more complete puzzle for developers.

The IDFA earthquake is accelerating evolution. Apple was already able to handicap FB/Google /et al even before implementing the ATT popup, but this may come and bite back. Harming the effectiveness of mobile performance marketing may not benefit Apple in the long term as much as claimed after the initial announcement : its tight control on the platform could very well be weakened by the awakening of app marketers that there’s an entirely world outside theirs. I know very few professionals who excel in both web & app environments, but I’m convinced cross-platform marketing is going to be a high-demand skill next year.

Notes:

This MADV post wasn’t emailed to subscribers, but attached in MADV 005.

* I noticed that Twitter started showing a small amount of MAI ads to LAT users recently, not sure if part of testing to expand reach?

** Overall inventory for which IDFA is null or non accessible is currently around 39% vs 25%, which is a +56%. It means the accessible inventory on SANs is down from 75% to 61% of overall, -20%. Depends how you want to look at it

***unless you add age/gender criteria in every single adgroup