After a few months in hiatus, some of you might wonder what is MADV or who I am and think that’s spam. Please don’t hit that button, unsubscribe is at the bottom.

Indeed, there was no episodes lately. Sorry, yet I had warned schedule would be irregular. Why? This newsletter takes time and it’s been entirely free for now: no ads, no affiliate link, no sponsored content. “No trick, no gimmick”. If you want to get MADV more often, feel free to send donations. Bitcoins welcome, just don’t paypal me. Or be like Andre, and send over a nice aged rum to the island!

I was also expecting a major event “early 2021” and wanted MADV to be past it, but here we are, hanging without any precise date… Hopefully we can rip the band-aid soon and move on.

💡 Noticeable news from Q1

As major ad platforms took back most targeting & optimization levers, UA managers increasingly focus on ad creative production, testing & deployment. AppAgent released a solid free ebook about their method & learnings (highlights)

“The best apps today are games in disguise” - I often tell app developers to get inspiration from gaming pioneers, and use the quote that “games are to apps what porn has been to ecommerce”. This is valid for UA, and for in-app tactics. a16z agrees

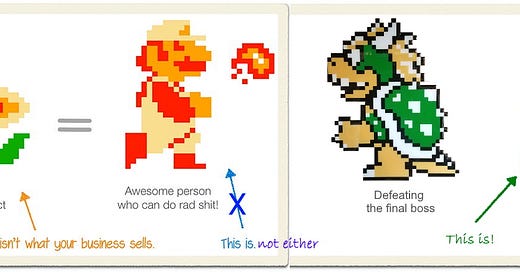

Another marketing advice I keep repeating is to prioritize benefits over features. I’ve updated my favorite illustration on this:

While CRO & UX practitioners rather focus on removing friction, adding friction can bring huge benefits, through credibility, personalization, commitment... Overlooked has relevant app use cases.

There was a ridiculous amount of M&A in adtech, including Adjust (Applovin), Algolift & GameRefinery (Vungle), Soomla (Ironsource), Adcolony & Fyber (DigitalTurbine). On top of that, IPOs are done or in the books for Huuuge, Roblox, Babbel, Playtika on one side, and IronSource, Applovin and InMobi on the other, although it’s becoming harder to draw the line between categories: the merging of gaming & adtech is one of the highlights of this recent trend, and it’s accelerating (I’ll let you guess why).

The ASO space was also heated, after AppFollow in Q4, AppTweak raised a $22m Series B, while AppRadar and TheTool merged.

It’s not only gaming & adtech, the photo editing space is also on fire, with Canva buying Removebg, Getty buying Unspash, Pinterest interested in acquiring VSCO. Who’s next?

Shamanth Rao repackaged learnings from his great podcast “The mobile user acquisition show” into a free pdf: “The Mobile Growth Handbook 2021”.

SensorTower shared 2020 stats on the “wellness” space and their billion installs. What attracted my attention was the rare but insightful split between Fitness, nutrition and the “emotional” segment. The former gets most volume, but the latter has 3x higher ARPU.

Within this “emotional fitness” space, mental health is very hot. While I see many startups coming to disrupt them (sleep, journaling, therapy, CBT…), established meditation apps keep growing: Calm shared milestones of 100m downloads & 4m paying subscribers before 2021 even started, it’s profitable since 2016 and doubled its downloads last year. Their lead seems to be increasing. Headspace got their Netflix show. Alexandra Borbely looked at Calm vs Headspace marketing approaches.

🔥 App Stores : antitrust, fees & scams

The AppStore revenue keep soaring even ahead of predictions. In Q1, iOS consumer spent rose another 40% yoy to $21b (AppAnnie data)

Last year, EPIC Games’ vocal stance against stores’ policy on payments (leading to Fortnite being kicked out both app stores), followed by the creation of the “Coalition of app fairness”, has attracted a lot of scrutiny on store fees. This is most likely what pushed Apple to open up a SMB program where developers earning less than $1m yearly can apply to get their fee down to 15%.

Some good news from Google, for once: following Apple lead, Google will also lower store fee by half later this year, and this will apply to all developers automatically. For many, that means $150k in extra cash in 2021!

As often, such fee reduction is really just a PR move, at times where GAFA are in the crosshair: the cost on the platforms bottom line is small in proportion to their gigantic profits - and funny enough the almost exact same number, the restrictive mechanics on the Appstore compensating for its 2x revenue.

It’s no news that app stores are winner-takes-all markets with huge concentration at the top, but I still found the stats following those announcement staggering: AppAnnie estimates that only 2.6% of iOS developers are over the $1m mark (on Play, not even 1% developers get there). The other 97.4% collectively represent 7.6% of revenue. If one zooms further, most of the elite of developers is not flying private to their beach in the Bahamas neither. On the other side of the spectrum, over half of AppStore revenue is made by developers earning 50+m yearly. (AppFigures)

One of the justification of the 30% fee, beyond payment processing and discovery, is that the app stores create “a safe and trusted” environment. While the lax control on Play makes this debatable, some horror stories also affecting the AppStore are putting stress to the argument. One of the latest instance is crypto fishing through a fake Trezor app. Avast shared no less than 134 examples of “Fleeceware” on iOS, with over half a billion installs and $365m in revenue… There’s no lack of reporting of scams, especially involving subscriptions apps. AppsExposed, Kosta eleftheriou, DrBarnard, Marco Arment, Ryan Jones & others have reported them for years, while proposing solutions. The pattern is often clear: fake ratings & reviews, hardcore paywalls at first launch, insane weekly prices, aggressive ads (for example here on TikTok). TheVerge, Techcrunch and other media outlets helped give the problem visibility, but Apple is moving slowly (uninstall popup last year, weekly pricing now?) but this harm done to consumers is a real concern for legit developers.

📈 Benchmarks

A wise friend told me we shouldn’t focus so much on benchmarks. The way I see it, "A good conversion rate is one that's better than yesterday”. It means you're improving, understanding your users better. Better measure your product to its past version than spending time researching your neighboor's dick size.

Just 2.2% convert into a paid subscription in the US: qonversion.io released subs benchmarks, with a split by country of install-to-trial & trial-to-payment stats.

Appsflyer trove of data is a great source for retention stats. Day-30 stands at 4.5% on organic and 3.5% elsewhere. (no idea about the methodology leading other providers to quote 66% ).

Talking about Day-30 retention: SuperCell aims at 20%! No wonder they get to kill some many projects, but those surviving are that successful. Let’s see what happens with its 3 new Clash titles.

Airship shared some useful push notification & re-engagement benchmarks. on iOS, 51% opt-in and 3.4% open the 8,8 average monthly PN per user.

Free dashboard with Facebook CPMs trends (200b impressions by GuptaMedia).

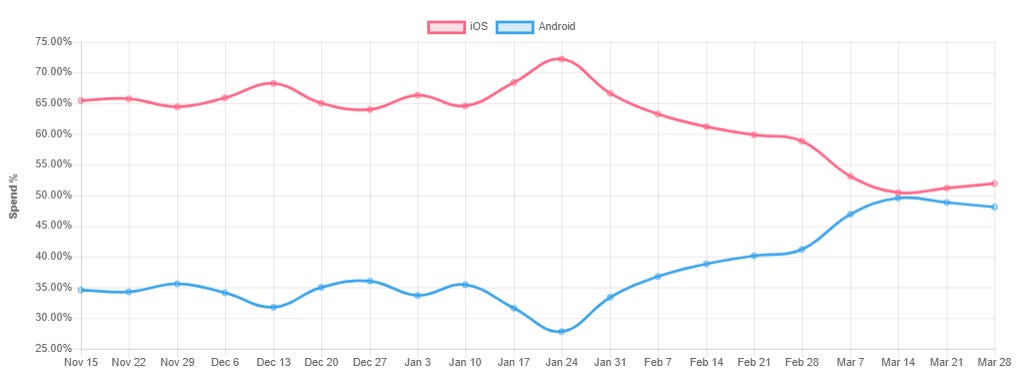

ConsumerAcquisition has mobile app specific figures. Can anyone explain what happened there, with iOS/Android media spend moving from x2 on iOS to almost the same mid March?

☑️ Subscriptions FTW

I keep seeing growing demand around subs pricing testing. As the pool of skilled people is small (the 5-6 people I know in that field are fully booked, and none wants to work in-house anymore), many do it themselves. Some are open enough to share their process & findings, such as Zach and his useful tips on paywall testing. SubClub is also an awesome place to exchange these.

Other approach it through tooling. Adapty & Purchasely both unveiled a no-code offering to help streamlining paywalls A/B tests as well as provide guidance on getting through review by following Apple’s moving guidelines.

Subs app tools are a fairly new space, I’ve heard about no less than 3 VC rounds being closed in the subs management layer of this tool stack from TheAppFuel

Trial, intro offer, lifetime, day pass, discounts… Things can get complicated, but here’s a great work from Jakub Chour, deconstructing when/how to price subscriptions depending on your subs category & steps of the user journey.

Among other insights from the qonversion.io benchmark mentioned above, 39% of free trials being cancelled within 24h is scary. Here’s a brilliant article from Blinkist on how to battle against free trial cancellation, this time betting on transparency. I’ve seen a couple developers copying that method (with varying degrees of success…)

That clever flow was featured in TheAppFuel’s free pdf among other 30 leading subs apps in-app secret sauce. Great resource!

Another dev sharing learnings openly is Jake from Fitness.ai, illustrating in this thread how moving to web payments for apps isn’t as trivial as some think

I have updated my Twitter list of subscription apps accounts.

🤳 First party content!

“We listen to your feedback” has lost most of its meaning since a tech giant decided to use it as a running gag and act the opposite. A few MADV readers told me they don’t want a list of webinars & panels like in episode 006. Here are still some free content that might peak your curiosity, check the “speaker” section of my Linkedin for more of those. And for those with no time to attend all those post-covid webinars, remember growthgems.co does the curation & summary job for you (and your team).

Mobile growth & Pancakes podcast

MDM podcast: Why doesn't Google have to show the prompt?

Incrmntl & Vungle 2021 & beyond predictions and premonitions

“RAMA: subscription apps from acquisition to revenue” (Slides on-demand)

I haven’t included the HR section, but if you’re looking for work as a UA manager, Senior PM or subs monetization lead, hit me up!

I had deep dives on Roblox & Strava planned, but it’s getting to gmail size limit already. Instead I’ll end on that note: I’ve decided to rewatch HBO’s Silicon Valley last month, all 6 seasons, and while I knew what to expect, I can only recommend you to do the same. It’s so real it’s frightening. Huge laughs again too. Recently, I noticed some services with PiedPiper winks in their onboarding, such as the sign-up form on growth.design. Just avoid Pipey the piper.... Well Bitclout has Clippy, so what could go wrong?

If you do want to show your appreciation for MADV and incite me to write more regularly, but didn’t find the btc address in the header note, maybe you’ll consider a Cameo from Russ about MADV :) In the meantime, I’ll go and chase my second comma.